Read More from the Camel Crew

Food

Explore healthy, delicious meal ideas to nourish your body and keep you energized all day. Discover recipes, cooking tips, and balanced diet plans.

Medical

Get trusted health advice, learn about common conditions, and stay informed about preventive care for a healthier, longer life.

Medical Insurance

Understand your options, compare plans, and make informed choices to protect yourself and your family with the right medical coverage.

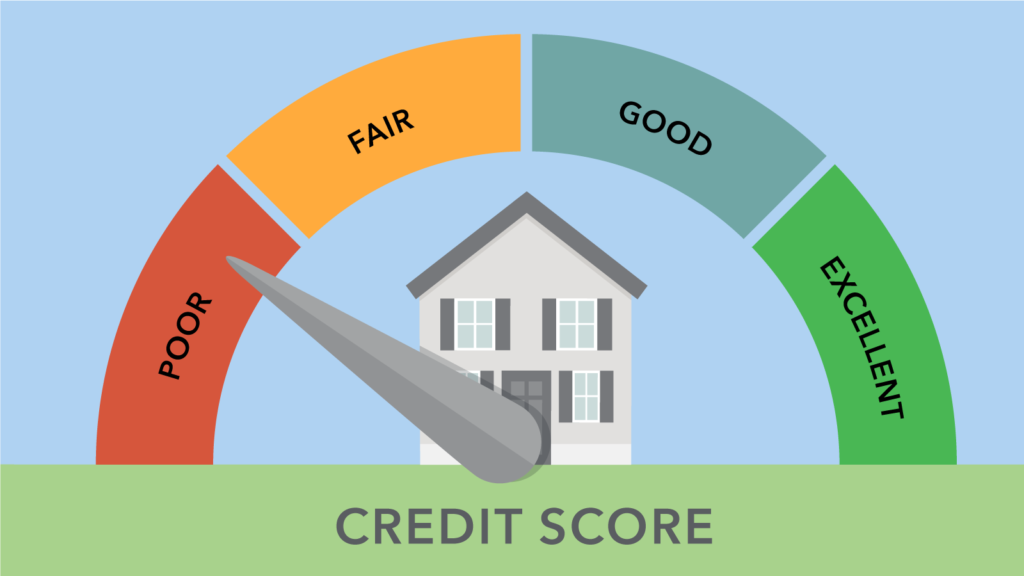

Protect Your Health with the Right Medical Insurance

Medical insurance is your safety net against unexpected healthcare costs. From routine checkups to major treatments, the right coverage ensures you and your family get quality care without financial stress. Choose a plan that fits your needs, so you can focus on living healthy and worry-free.

-

Covers hospitalization, surgeries, and specialist visits

-

Includes preventive care and routine health checks

-

Access to a wide network of hospitals and clinics

-

Financial protection against rising medical costs

-

Options for individual, family, and senior plans

Food, Medical & Insurance – Your Top Questions Answered

How can I maintain a healthy lifestyle through diet, regular check-ups, and proper insurance coverage?

A healthy lifestyle starts with balanced nutrition—eat plenty of fruits, vegetables, whole grains, and lean proteins while limiting processed foods and sugar. Regular medical check-ups help detect potential health issues early, allowing for timely treatment. Medical insurance ensures you can access quality healthcare without worrying about high costs, giving you peace of mind and long-term protection.

What are the key things to consider when balancing nutrition, preventive healthcare, and financial protection?

-

Nutrition: Choose fresh, nutrient-rich foods to strengthen your immune system.

-

Preventive Healthcare: Schedule regular health screenings and follow your doctor’s advice.

-

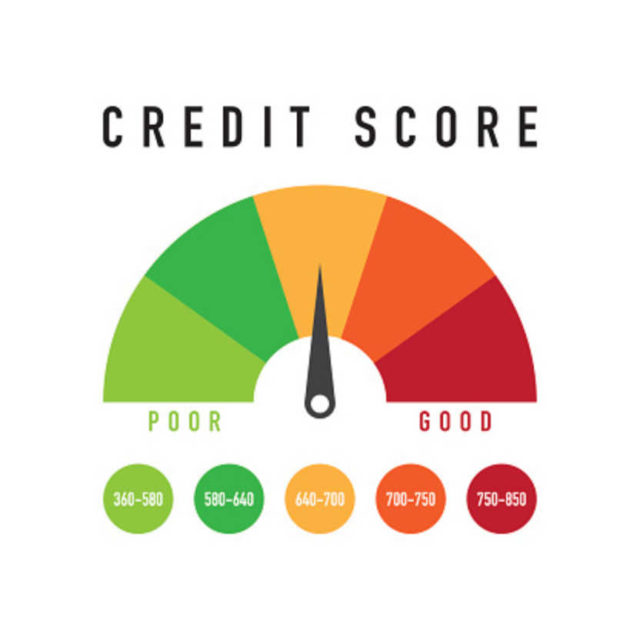

Financial Protection: Select a medical insurance plan that covers emergencies, hospitalization, and preventive care.

Balancing these three ensures both physical and financial well-being.

Why is it important to combine healthy eating, medical care, and insurance for overall well-being?

Healthy eating reduces the risk of chronic diseases, while medical care addresses existing health issues and prevents new ones. Medical insurance provides a safety net for unexpected expenses, ensuring you never have to delay treatment due to cost. Together, they form a complete approach to living a longer, healthier, and worry-free life.

What are some simple ways to improve my daily nutrition?

Focus on whole foods like fruits, vegetables, whole grains, and lean proteins. Reduce processed foods and sugary drinks, and make sure to stay hydrated throughout the day.

When should I see a doctor instead of self-treating?

Seek medical attention if symptoms are severe, persistent, or unusual. This includes high fever, chest pain, sudden weakness, difficulty breathing, or injuries that won’t heal.

How does a cashless medical insurance claim work?

In a cashless claim, the insurance company directly settles your hospital bills with a network hospital, so you don’t need to pay upfront (except for non-covered charges).

Find Out More

Check out the following articles and get started on the next step of your financial journey